what taxes do i pay after retirement

Ad Experienced Support Exceptional Value Award-Winning Education. The IRS will withhold 20 of your early withdrawal amount.

9 States That Don T Have An Income Tax Income Tax Income Tax

Throughout your working years youve paid payroll taxes for Social Security and Medicare.

. Married taxpayers who file joint returns are taxed on 50 of. TD Ameritrade Offers IRA Plans With Flexible Contribution Options. There are two ways which taxes are typically paid.

File a Free Federal Tax Return as a Senior Citizens. If your combined income is more. The first 9950 of taxable income would only be taxed at 10.

Social Security will withhold benefits at the following rates in 2021. 1 for every 2 of earned income above 18960 until the year you reach full retirement age. However there are narrow exceptions to.

One downside is that there are. Lets say youre 64. For the 2022 tax year which you will file in 2023 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security.

A Wise Friend and Fierce Defender in Your Corner. Your entire benefit from a taxed super fund which most funds are is tax-free. When you take distributions the money you take each year will.

Ad Download The Definitive Guide to Retirement Income from Fisher Investments. Individual retirement accounts IRAs are a popular way to save for retirement but there are some drawbacks to consider before opening one. Retirees with high amounts of monthly pension income will likely pay taxes on 85 of their Social Security benefits and their total tax rate might run as high as 37.

Ad Download The Definitive Guide to Retirement Income from Fisher Investments. The short and general answer is yes individuals and couples generally have to pay taxes in retirement. The rest of the.

Some of the taxes assessed while working will no longer be paid in. You may end up declaring as much as 85 of your Social Security income to be taxed. Make strategic withdrawals.

Taxes on Pension Income. Everyone working in covered employment or self-employment regardless of age or eligibility for benefits must pay Social Security taxes. Fisher Investments shares these 7 retirement income strategies to help you in retirement.

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs and similar. After you reach age 72 you must begin taking required minimum distributions RMDs from certain tax-advantaged retirement accounts such. Part is tax-free made up of.

If your annual income exceeds 34000 44000 for married couples 85 of Social Security benefits may be taxed. For most workers thats 62 percent Social Security and 145 percent Medicare of. Our tax law provides for a pay-as-you-go system which requires taxes to be paid on income as it is received.

If youre age 60 or over. But if you have other income streams then some of your SSI may be taxed. It can increase to 85 of your benefits if your income including half of your benefits is more than 34000.

Your 401 k contributions are put in before taxes have been paid and they grow tax-free until you take them out. For example if you make an early withdrawal of 10000 at age 40 from your 401 k you will get about 8000. The program is funded by.

Open an Account Today. Because payments received from your 401 k account are considered income and taxed at the federal level you must also pay state income taxes on the funds. Ax T Withholding You can.

IRS approved e-file provider. Ad E-File Directly to the IRS Free e-File. If your combined income is between 25000 and 34000 for a single filer you may owe income tax on up to 50 percent of your benefits.

In fact my standard deduction would be 1700 higher if I were age 65 or older this year. The amount of money you get each month depends on how much money you earned during your career and how old you were when you retired. Then the next bucket of.

Fisher Investments shares these 7 retirement income strategies to help you in retirement. Ad AARP Is Providing Trusted Health Information Caregiving Advice and Battling Fraud. As with other income distributions from traditional.

State By State Guide To Taxes On Retirees Retirement Income Dividend Stocks Mutuals Funds

Check Out This Simple Guide For Retirement Choices Retirement Investing Finance Investing Acorns Investing Stash Inv Investing Investing Money Roth Ira

States That Dont Tax Social Security Social Security Benefits Retirement Retirement Strategies Map Diagram

Retirement Opening A Backdoor Roth Is Not Always The Best Approach Finance Investing Smart Money Investing

If You Re Already Contributing The Irs Maximum Amount To Your 401 K And Would Like To Keep Reap Saving For Retirement Finance Saving Personal Finance Bloggers

What Is A Financial Plan And How Do You Make One Dollarsprout Personal Financial Planning Financial Planning Money Management Advice

How Much Can We Earn In Retirement Without Paying Federal Income Taxes Early Retirement Now Federal Income Tax Income Tax Capital Gains Tax

State By State Guide To Taxes On Retirees Retirement Retirement Income Tax

Do I Need To Pay Taxes After Retirement Liberty Tax Service Sales Jobs Life Insurance Beneficiary Tax Services

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

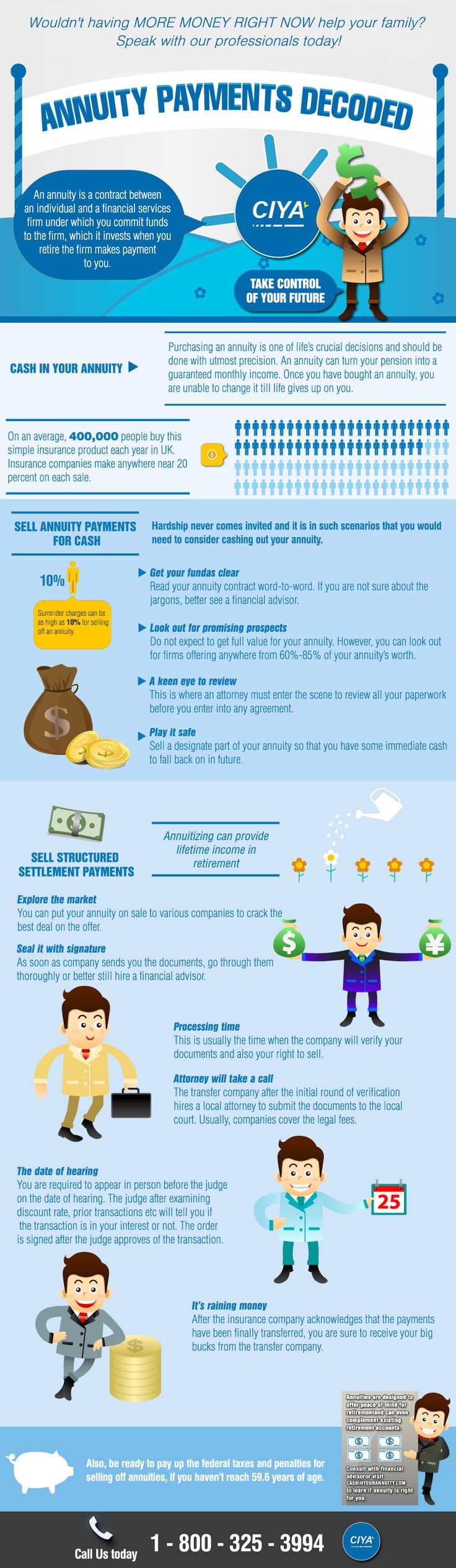

Annuity Payments Decoded Annuity Lifetime Income Retirement Strategies

See How Each State Taxes Retirees In Our State By State Guide To Taxes On Retirees Social Security Benefits Social Security Social

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

From Instagram But Extremely Helpful Take Money Traditional Ira Roth Ira

Savvy Tax Withdrawals Fidelity Financial Fitness Tax Traditional Ira

Top 3 Benefits Of Roth Ira Individual Retirement Account

Pin By Modern Finance On Financial Planning Investment Accounts Tax Money Deferred Tax

Seven Things You Can Do Now To Prepare For Tax Time Plan Well Retire Well Tax Time Tax Preparation Show Me The Money