tennessee inheritance tax rate

All inheritance are exempt in the State of Tennessee. All inheritance are exempt in the State of Tennessee.

How Taxes On Property Owned In Another State Work For 2022

In Tennessee the median property tax rate is 685 per 100000 of assessed home value.

. Inheritance taxes in Tennessee. The estate tax is often referred to as the death tax. Each state sets its own inheritance tax rates and exemptions based on the value of the estate as well as the relationship of the beneficiaries.

Year of death must file an inheritance tax return Form INH 301. Up to 25 cash back Update. Also estates of nonresidents holding property in Tennessee must file Form INH 301.

However if the value of the estate. Tennessee and Federal Estate Tax Exemptions Raised Today for 2014. Until that time estate.

Tennessee Inheritance and Gift Tax. Today the Tennessee inheritance tax exemption for 2014 is raised to 200000000. No estate or inheritance tax.

There are NO Tennessee Inheritance Tax. The Hall Income Tax will be eliminated by 2022. However if you taxpayers will find themselves.

There is a chance though that another states inheritance tax will apply if you. Currently only six states require. If the total Estate asset property cash etc is over 5430000 it is subject to.

IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State. IT-11 - Inheritance Tax Deductions. This is for good reason as it only applies once someone passes away.

There are NO Tennessee Inheritance Tax. There are NO Tennessee Inheritance Tax. The schedule for the phase out is as follows for the tax rate.

2016 Inheritance tax completely eliminated For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Inheritance Tax Due Date and Tax Rates File and Pay Exemptions Consent to Online Transfer Forms Publications and Other Resources Inheritance Tax Forms Note.

What is the inheritance tax rate in Tennessee. In 2016 the inheritance tax will be completely repealed. The net estate less the applicable exemption see the Exemption page is taxed at the following rates.

For deaths occurring in 2016 or. Tennessee Estate and Inheritance Taxes. The inheritance tax is due nine months after death of the decedent.

In 2012 Tennessee passed a law to phase out the estate or inheritance tax over time. Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015. Inheritance Tax Due Date and Tax Rates File and Pay Exemptions Consent to Online Transfer Forms Publications and Other Resources Exemptions There is a single.

If the total Estate asset property cash etc is over 5430000 it is. If the value of the gross estate is below. If the total Estate asset property cash.

IT-12 - Inheritance Tax Deduction - Real Property Sale Expenses. 4 of taxable income for tax years beginning January 1 2017 3 of. Tennessee does not have an inheritance tax either.

All inheritance are exempt in the State of Tennessee. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

Annuity Taxation How Various Annuities Are Taxed

2022 State Tax Reform State Tax Relief Rebate Checks

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax

Implementation Of Road Safety Measures By Providing Sign Boards

Annuity Taxation How Various Annuities Are Taxed

Alabama Counties With The Largest Property Tax Payments In 2018 Acre

Irs Announces Higher Estate And Gift Tax Limits For 2020

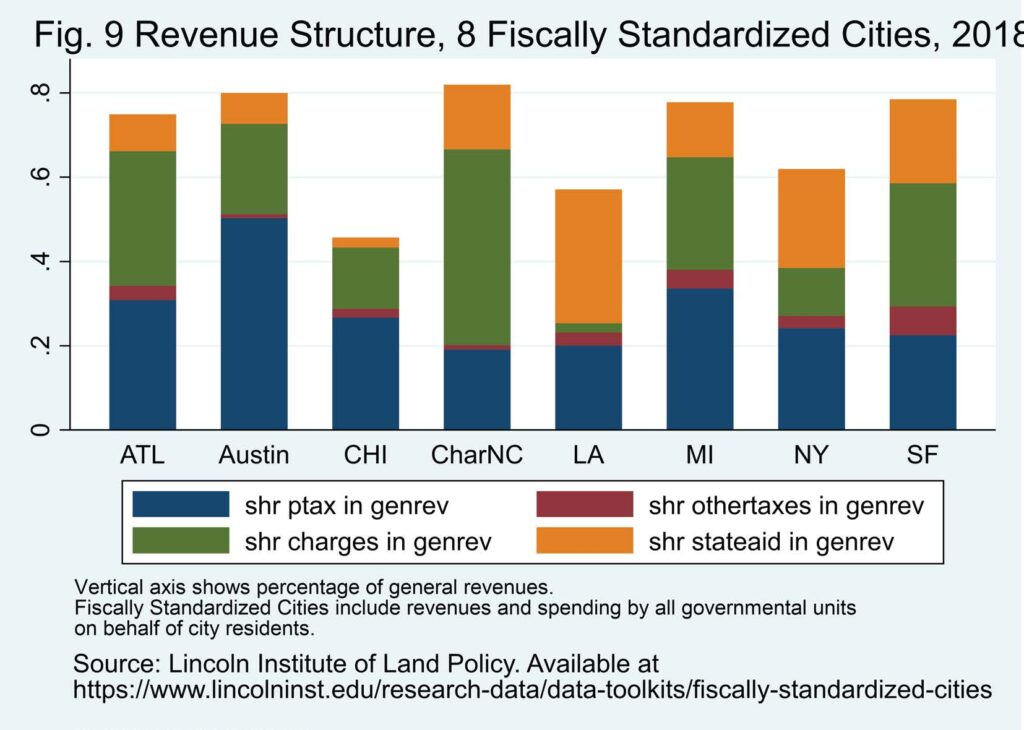

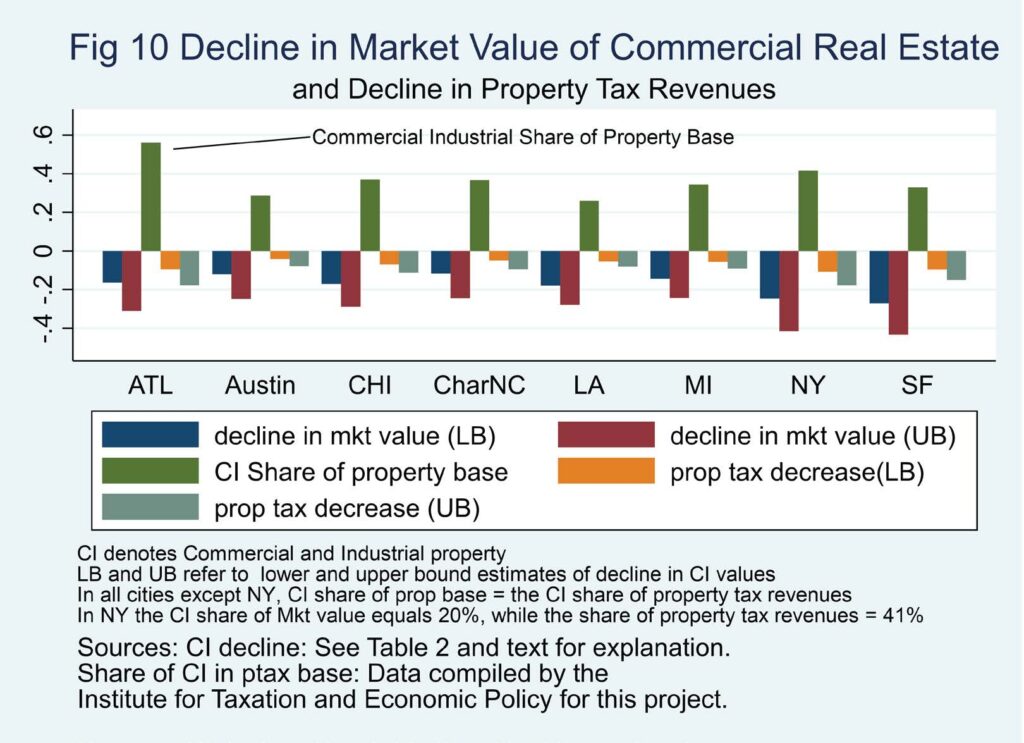

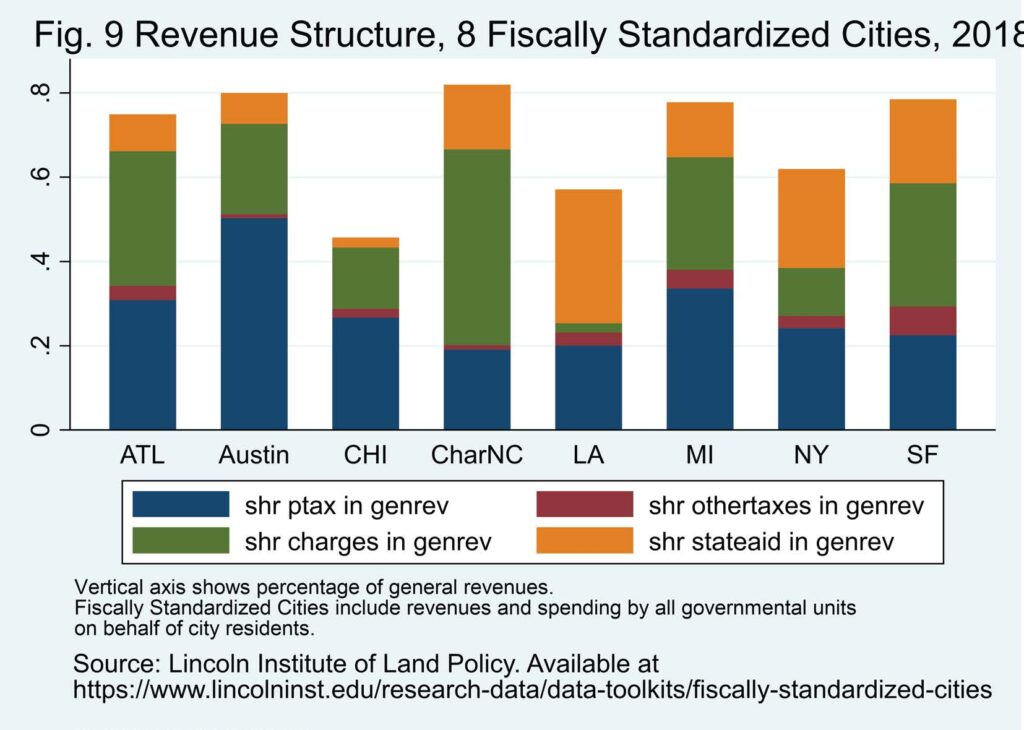

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

How Much Tax Will I Pay If I Flip A House New Silver

Pay Taxes Fees Tax Administration

Altered State A Checklist For Change In New York State Empire Center For Public Policy

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation